Demo

RD-FD SOFTWARE

In network marketing, the term " RD/FD software" is relatively new. Since we are well-versed in the idea of MLM and its advantages, we can anticipate this marketing strategy's implementation. Rd-Fd stands for "regular deposit" and "fixed deposit," credit cooperative societies and Nidhi Limited companies typically use this software solution. These institutions offer us the chance to invest our money for a return after a predetermined period, perhaps to put toward a future real estate or precious metals purchase.The term "recurring deposit" (RD) refers to a kind of deposit in which the client makes regular deposits to a business on a regular schedule (often daily, weekly, or monthly) and then withdraws the principal and any accrued interest at the end of the term.The term "recurring deposit" (RD) refers to a kind of deposit in which the client makes regular deposits to a business on a regular schedule (often daily, weekly, or monthly) and then withdraws the principal and any accrued interest at the end of the term.

Fixed deposit is abbreviated as FD. A consumer may choose to invest their money for a year, two years, three years, or longer, and then, at the end of that time, they will get the predetermined amount from the business. The MIS is another plan that uses this option. It goes into detail as Monthly Income Plan. In this plan, the depositor makes monthly installments and receives the necessary amount plus interest at the end of each month.Manually tracking all of the RD-FD transactions and calculating the interest would be a nightmare for any company looking to get the ball rolling on the RD-FD MIS system. This is why they need to subscribe to the RD-FD software package. It's used to keep track of reports, including those that have reached their maturity or have crossed international borders, as well as lists of customers and those who have payments coming due. Even with tremendous human effort, it remains impossible. Therefore, it makes sense to use MLM Software India's support.

What The Rd Fd Software Has To Offer

- Agent enlistment, plan customization, agent status configuration, and compensation plan customization

- Date of maturity, commission, and late deposit penalty calculations

- Reports on RD payments that are soon due.

- Printing and creating receipts

- Taking care of business with clients, reps, and affiliates

- Produces FD's Bonds, Checks, and Passbook.

- Many different options depending on what the customer needs

Advantages of Fixed Deposits

- Your principal is safe in a fixed deposit, and you only risk losing money if you cash out before the maturity date. The possibility of fraud is removed when dealing with RBI-controlled cash.

- Interest Rate Guarantee: Because of the set interest rate, you may feel sure you will earn money from your FD investment. Even if they are predictable, they will nonetheless increase the value of your assets.

- While fixed deposits (FDs), in general, are a safe investment option, you should still research the company's reputation before committing any money. You should know the deposit's credit rating before putting money into it.

- Understand the withdrawal rules of your chosen fixed deposit type to avoid any unwanted surprises down the road—early withdrawal fees from a bank's designated deposit account range from 0.1% to.75%.

- You can tailor your FD investment to your specific needs and objectives. If you choose a non-cumulative deposit type, your money will earn monthly interest. These also provide higher returns than standard financial vehicles like savings accounts.

The Advantage of Regular Deposit

- An effective investment strategy is a recurrent deposit program in which the investor commits to saving a certain amount of money every month.

- Recurring Deposits are the best option since they make it easy for customers with regular incomes to save a certain amount of money regularly. The investment is safeguarded from fluctuations in interest rates since the RD interest rate is likewise locked in. Guaranteed returns are a common feature of RD programs.

- Since RDs provide instant access to funds in the event of an unexpected expense, they are considered highly liquid. Early withdrawals are usually allowed, but you should know that doing so might reduce your interest rate or subject you to a punishment.

- Investing in an RD is a breeze since you may set up automatic deposits into your account regularly. The customer needs to ask the bank once each month to credit their account with money from their linked savings or checking account.

If you cannot afford to invest a significant quantity all at once but still want to put some of your money to work, a recurring deposit (RD) may be the way to go. Those with the lowest tax rates who are risk averse are the best RD and FD investors. Use a recurring deposit calculator online to determine the best strategy for your budget. RDs are preferred by many owing to their much reduced financial burden and roughly equivalent returns to FDs, even though a single investment product cannot meet all goals.

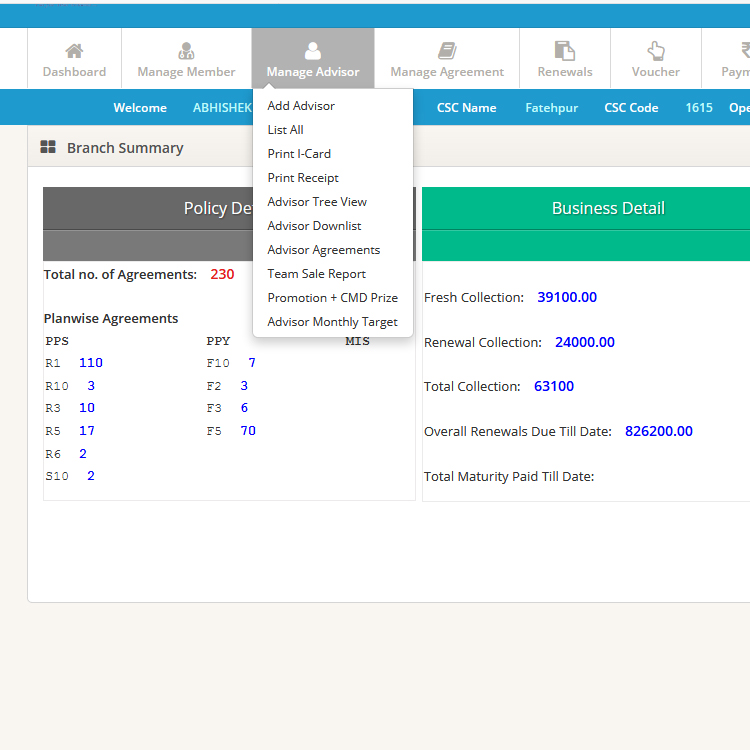

Our RD & FD Software includes

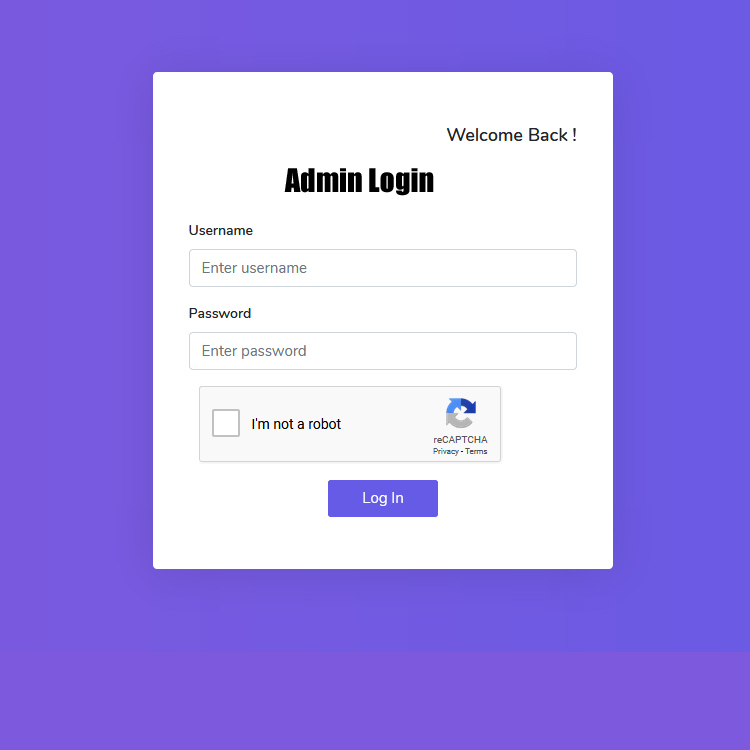

Administration Settings- Manage Admin

- Manage Designation / Rank

- Manage Category like:- RD , FD

- Manage Terms

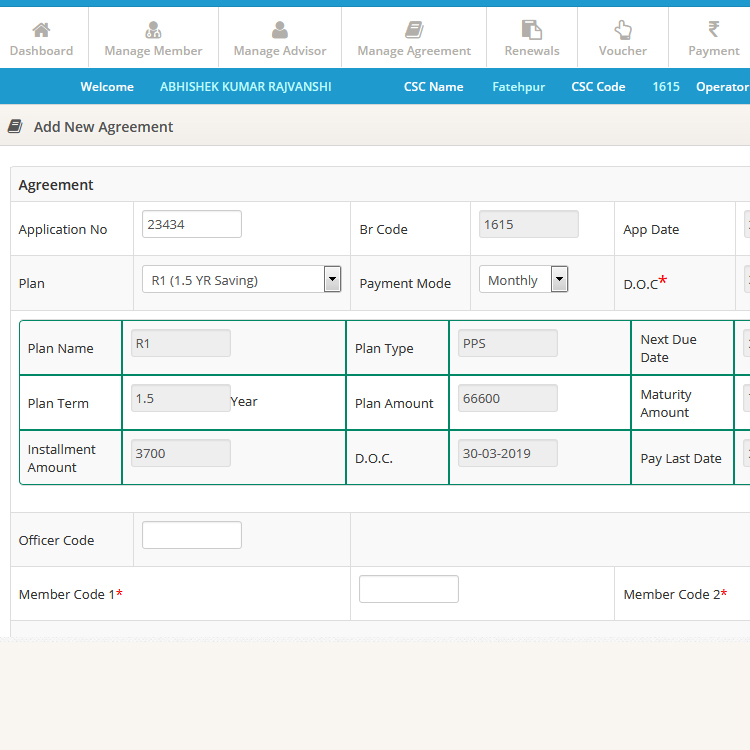

- Manage Plan

- Manage Installment Plans

- Manage Package

- Manage Surrender

- Manage Deduction (TDS / Services Tax)

- Manage Web Content

- Manage News

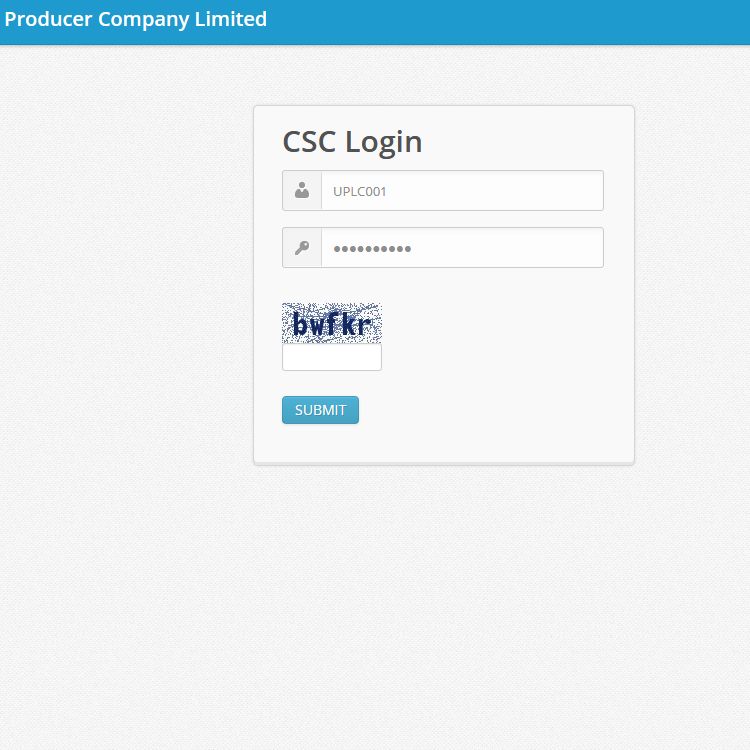

- Add Branch

- Manage Branch

- Registration Form

- Manage Investors

- List of Investors List

- Self Joint Venture List

- Maturity List

- Monthly Maturity List

- Registration Form

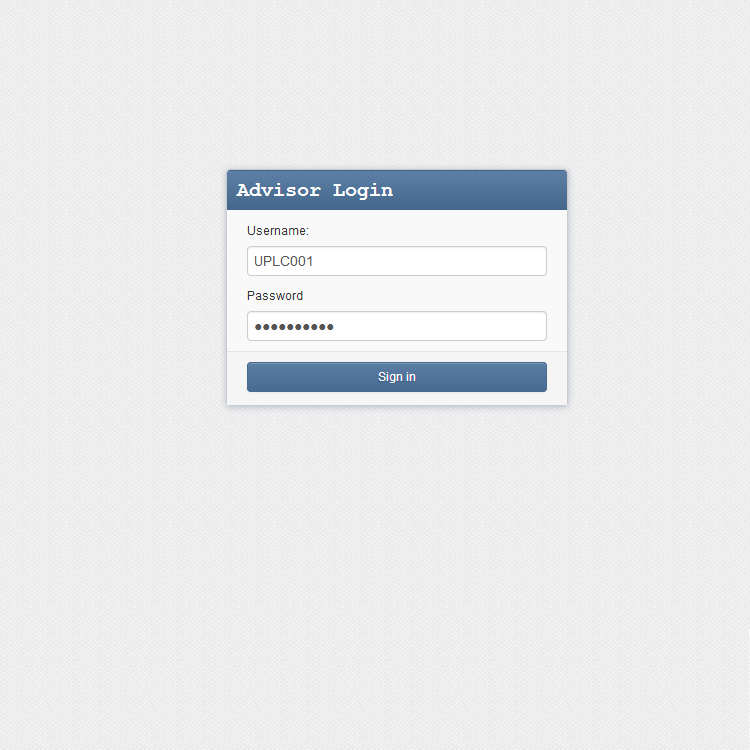

- Manage Associates

- List of Associates

- Self Distributor List

- Money Receipt

- Passbook

- Surrender Plan

- Rd Renew Term

- Rd Renew Receipt

- Rd Deposit Receipt

- Repay MIS Installment

- MIS Installment Report

- Joint Venture Report

- Associate Report

- Voucher Report

- New Collection

- Old Collection

- Commission Associate Report

- TDS Branch Report

- Total TDS Report

- Excel Data Import.

- Excel & PDF Data Export.

- Tally comfortable.

Our RD & FD HR-Payroll software includes

Administration- Update admin.

- Add financial year.

- Add employee.

- View/update employee details.

- Basic information.

- Bank details.

- Address information.

- Salary details.

- Update PF and ESI Percentage.

- PT Slab.

- ESI Slab.

- Income Tax Configuration.

- Add Employee Attendance.

- Create Salary.

- View Salary Information.

- Holiday List.

- Salary Reports.

- Statutory Reports.

- Payroll MIS Reports.

- Leave Reports.

- Excel Data Import.

- Excel & PDF Data Export.

- Tally omfortable.